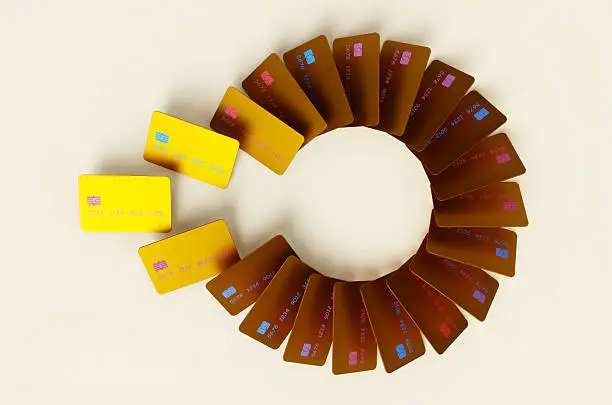

The burden of debt seems harder every day. Every consumer wants to reduce the stress of debt repayment. This time Balance Transfer Credit Cards USA has become the best plan. These cards transfer debt from a higher rate to a lower rate. Zero fees and long zero plans provide savings to the user. Smart Deal makes borrowing fast and easy. Balance Transfer Credit Cards USA help customers save cash and live a stress-free life.

Smart Pick makes the clear loan dream a reality. Each bank card has a different feature and a distinct advantage. The Loan Cut and Pay Tool gives hope to the user. USA’s top ten cards are the perfect step toward a debt-free life. It is important for the customer to choose the right card. Balance Transfer Credit Cards USA makes the user’s life safe and stress-free by being the smart choice.

Best Card USA

Every smart consumer needs a clear loan plan. Balance Transfer Credit Cards USA offers a zero-fee and secure plan. Loans transfer from a high rate to a low rate. The user gets a cash-saving and stress-free payment tool.

Chase Card USA

The Chase card offers a clear long-term debt plan. Chase Card is the leader in credit cards for balance transfers in the USA. The zero-fee and stress-free pay option is a smart deal. The consumer saves cash and cuts debt faster. The Long Zero Plan makes life clearer and safer.

Citibank USA

The Citicard Loan Shift tool is a great choice. Balance Transfer Credit Cards Citi Plan has got a big name in the USA. A zero rate and secured payday loan reduces stress. The user gets both convenience and cash savings. Citibank is a great step towards a debt-free life.

Zero-rate plan

Citibank’s zero-rate plan offers a longer term. This is the top option in Balance Transfer Credit Cards USA. Both loans are less stressful and easier to repay.

Safe Shift Tool

The Citicard Loan Shift is a safe and transparent plan. Balance Transfer Credit Cards USA gives the user a stress-free step. The smart tool makes loan repayment flexible.

Kish Siu Gin

Customers get both cash savings and incentives. Balance transfer credit cards in the USA give the Citi card a huge advantage. Reducing debt is easy and saves time.

Smart user pick

Every smart user gives Citi Card the top pick. Balance transfer credit cards are the best move in the USA. The path to a debt-free life is achieved through Citicard.

Wells Card USA

Wells Card Loan is a cut-and-pay-as-you-go plan. Balance Transfer Credit Cards USA Get Wells Smart Rank. A long zero and secure plan relieves the stress of debt. The user saves time, and the pay is light. This card is perfect for every smart user.

Bank of Rich America

Bank Amir makes the debt-free dream come true. Balance transfer credit cards in the USA are an obvious shift tool. A zero fee and secure plan reduces debt stress. The user saves cash and pays flexibly. Bank Aamir Pick gives smart and clear benefits.

Discover Card USA

Discover Card Loan Shift is a smart tool. Discover is the top balance transfer credit card in the USA. A zero rate and cash perk give a double benefit to the user. Debt repayment provides a light and stress-free plan. The user saves by using a smart card.

U.S. Bank USA

US Bank Visa Loans are considered a clear tool. In Balance Transfer Credit Cards USA, the name is SMART. A long zero- and low-fee loan reduces stress quickly. The user gets both a clear salary and cash savings. US Bank is the best deal for smart customers.

Long Zero Plan

The US Bank Card is the perfect tool for the Long Zero Plan. Balance transfer credit cards are a clear bargain in the USA. Debt stress is reduced, and repayment time is secured.

Less face shift

The customer gets low fees and secure loan shifting. This is a strong point of balance transfer credit cards in the USA. Smart Plan offers savings and convenience to the user.

Kish Siu Gin

The US Bank Card saves cash and offers rewards. Balance Transfer Credit Cards: USA customers get a double benefit. Debt is cut, and a stress-free salary is evident.

Smart user pick

The smart consumer chooses the US Bank Card as a top choice. Balance transfer credit cards are the best deals in the US. The debt-free dream comes true with US Bank’s plan.

Capital One USA

Capital One Loan Pay is a clear and secure card. It is the top name in balance transfer credit cards in the USA. The Long Zero Plan provides smart pay steps to the user. Debt reduction and cash savings are both obvious. Both Stress Free Life and Smart Save are available.

Zero-rate plan

The Capital One card offers a long zero plan. Balance Transfer Credit Cards USA makes payments stress-free. Debt reduction and cash savings are both obvious.

Safe Shift Tool

The customer gets a secure loan transfer and repayment facility. Balance Transfer Credit Cards USA Smart Plan Reduces Debt Stress

Kish Siu Gin

The Capital One Card offers both cash savings and perks. Balance Transfer Credit Cards: USA customers get a double benefit and save time.

Smart user pick

Every smart consumer chooses the Capital One card as a top choice. This is the best choice for balance transfer credit cards in the USA. Debt-free living is possible with the Capital One plan.

- A long zero plan reduces debt stress.

- Low fee and secure salary plan available.

- Cash savings and incentives add additional benefit to the user.

- The Smart Shift tool makes debt repayment easy.

- Fast plan is the top choice for customers.

- Balance Transfer Credit Cards USA is a stress-free and secure tool.

- The Capital One card offers smart picks and clear benefits.

HSBC Card USA

The HSBC Gold Card Loan is an obviously smart plan. HSBC’s balance transfer credit cards cost more in the USA. Zero plan and secured payday loan deduction. The user gets a stress-free life and saves cash. SmartPick is the best way to a debt-free life.

Barclays Card USA

Barclays Ring Loan is a flexible and clear payment instrument. This is the top card in the USA for balance transfer credit cards. Zero plan and secure deal benefits the user faster. Paying off debt reduces stress and saves cash. Barclays Pick provides smart and secure steps to the user.

Why choose a USA card?

The LoneKit tool makes smart plans and saves lives. Balance Transfer Credit Cards USA provides the user with a simple and clear payment plan. Choosing a smart card makes the debt-free dream come true. Customer stress is reduced, and cash is saved faster.

- A zero-rate long-term plan reduces debt stress.

- The cash save perk is the biggest benefit for users.

- • The Secure Loan Shift tool makes the user’s life easier.

- Smart Pick provides clear payment to every customer.

- Low fee and fast plan loan kit

- The long zero period saves the user cash and time.

- Balance Transfer Credit Cards USA is a stress-free and safe choice.

How USA Cards Work

Loan transfers from high rate to low rate. Balance transfer credit cards in the USA offer long zero plans. The customer cuts the debt and secures the payment step. One gets both cash savings and a stress-free life.

Pro-USA Cards

Zero rate and cash savings are top priorities. Balance transfer credit cards reduce stress and save time for USA consumers. Smart Deal makes life safer and easier. Every smart consumer can cut debt fast.

Cons of USA Cards

There are fees and risks with some cards. Balance transfer credit cards:Late payment rates are high in the US. A smart plan and timely payment keep the user safe. Debt reduction and repayment steps should be clear.

Tips USA Cards

Choose a smart plan to clear your debt. Pay Balance Transfer Credit Cards USA on time. Each step is explained and is a cash-saving tool. Consumers have to use the card cleanly and smartly.

Final Wave USA

Debt stress makes life slow and debilitating. Balance Transfer Credit Cards USA offers a debt reduction and savings plan. With Smart Pick, the debt-free dream becomes faster and clearer. The user gets both stress reduction and a safer life.

FAQs

What are the uses of balance transfer credit cards in the USA

These card loans shift to a lower rate than the high rate.

Balance Transfer Credit Cards USA is ending its zero-fee plan.

Yes, some cards offer zero fees and extended zero plans.

The USA Card saves cash for the user.

Of course, both debt reduction and cash savings are the biggest benefits.

What is the risk of balance transfer credit cards in the USA?

Late payments attract higher rates and are risky.

What should I check when picking up my USA card?

The user must check the Zero Plan Fee and Secure Payment option.